1c accounting 2.0 leasing on our balance sheet. Accounting for leasing on the lessee's balance sheet

20.08.2017

1. Basic– for one user who will install the program on his computer (most likely a laptop) and work in it alone.

Pros: cheap, no need to pay for updates.

Cons: As soon as you need to connect other users, you will need to switch to PROF. Why a laptop - software protection is “tied” to the computer and does not allow the program to be transferred from one computer to another. So you have to move the computer (for example, from the office to home and back).

2. PROF– a program for everyone: the number of users can be expanded, work in a local computer network, manage several organizations in one database, and much more.

Cons: you have to pay for updates (see ITS) and there is no accounting separate divisions.

3. CORP– this is a version of PROF, taking into account separate divisions, including those allocated to a separate balance sheet.

Varieties of the basic version

Protection of 1C programs from copying

1C programs use 2 types of protection against unauthorized copying: software and hardware. The type of protection must be selected when purchasing a license. If the program name contains USB, this is hardware protection. Everything else is software.

Hardware protection is based on USB keys (HASP). This key must be inserted into the computer you are working on. If you work on a computer network, then a network security key is used, which is inserted into one of the computers accessible to all users of this network.

Multi-user mode of operation

Versions of "1C: Accounting 8" PROF and CORP allow you to work on a computer network. That is, several users gain access to a common information base and work with it simultaneously.

To connect a second user to the common 1C: Accounting 8 database, you need to purchase one client license. These licenses are the same for all 1C programs on the 1C:Enterprise 8 platform. They also come with software and hardware protection. It is recommended to stick to one type of protection, but it is not necessary.

If your information base is stored in SQL DBMS format (Microsoft SQL Server, PostgreSQL, IBM DB2 or Oracle Database), to access this database you will also need a license for the 1C:Enterprise 8 server.

Support for 1C programs

Support for 1C:Accounting from the developer is a necessary component of its operation, since without updates to reporting forms and compliance with current legislation, the program will quickly lose its relevance.

Basic versions are provided with free support from the 1C company in terms of receiving updates via the Internet and consultations on using programs. The duration of this support is not defined, although it is not infinite. The end of free support may be announced if fundamentally new versions of the platform are released or other important circumstances arise.

Versions PROF and CORP are supported by 1C on the basis of an information technology support (ITS) agreement. This agreement is usually concluded between the user and the partner of the 1C company. There is an exception: an online ITS agreement is concluded directly with the 1C company (this is possible in the case of purchasing a supply for retail distribution).

There are 2 levels of ITS agreement: TECHNO And PROF. ITS TECHNO - the minimum possible level of support: receiving program updates, one consultation per month. ITS PROF means an unlimited number of consultations, full access to the ITS information system, attendance at the weekly "1C: Lecture", "1C: Counterparty", "1C: Reporting" and much more. Updates are also included in ITS PROF.

Transition to new versions and editions of 1C: Accounting

Transition from basic version to PROF

Users of the basic version, for whom the program's capabilities will become insufficient as their business develops, can purchase "1C: Accounting PROF" on preferential terms, including the cost of the basic version. In this case, the credentials accumulated in the basic version are completely transferred to the new program.

Transition from PROF version to CORP

The transition from the PROF version to the CORP version is similar to the transition from the basic to the PROF version. There are preferential terms program purchases (). The accumulated credentials are saved, but it will be necessary to further configure the program taking into account the use of separate units.

Accounting for leasing on the lessee's balance sheet

Please note

The initial value of the property that is the subject of leasing is recognized for TAX ACCOUNTING amount of expenses of the LEASOR for its acquisition, construction, delivery, production and bringing it to a state in which it is suitable for use - clause 1 art. 257 Tax Code of the Russian Federation . IN Tax Code it is not specified on whose balance sheet the leased property should be taken into account. Therefore, both when accounting on the balance sheet of the lessor and when accounting on the balance sheet of the lessee FOR TAX accounting, the initial cost of the property is the amount of the lessor's expenses.

Before putting it into operation, the cost of the non-current asset must be reduced in NU by the “lessor’s markup”, which in turn includes the redemption value of the property. Since the program makes a “cost adjustment” at the end of the month, which reverses this operation, we will carry it out a month earlier. (regardless of the actual arrival on 08.04)

We temporarily move the purchase price to 03/08 in order to return the OS to the NU through the “OS Modernization” document at the time of purchase. We transfer the remaining part to account 97 in order to distribute it over the entire term of the leasing agreement.

We put it into operation and see that the cost in BU and NU is different: in BU = the cost of the leasing agreement, in NU = the cost of the object of the leasing agreement (without the lessor’s markup). We fill out the document itself as a regular OS without accelerated coefficients with a period according to the depreciation group.

Every month we enter transactions that reflect the leasing payment in the organization’s expenses; in the NU we indicate the amount minus the costs reflected in CT 97.

When introducing such an operation, the program does not consider depreciation according to non-relevant assets for these fixed assets.

After the end of the leasing agreement, in NU the cost of fixed assets should be equal to 0, in BU it continues to be accrued. According to OS accounting, we must deliver the OS at the redemption price, for this we use the document “OS Modernization”, we use the costs reflected in the NU on account 08.03, nothing changes in the accounting system.

In this article we will look in detail at ways to reflect transactions under a leasing agreement in Enterprise Accounting 3.0.

The word "leasing" is borrowed from English language. It comes from the verb “to lease”, which means “to rent, to rent”. Indeed, there are many similarities between leasing and renting. However, these concepts should not be identified.

Rent consists of the lessor transferring his property for use and temporary possession to the lessee for a fee. The object of lease can be both movable and immovable property, including land plots.

Leasing(the so-called financial lease) consists in the fact that the lessor undertakes to acquire ownership of new property specified by the lessee from a specific supplier and provide this property to the lessee for a fee for temporary possession and use (clause 4 of Article 15 Federal Law dated October 29, 1998 No. 164-FZ). The subject of a leasing agreement can be any non-consumable items. As a rule, these are fixed assets, with the exception of land plots and environmental management facilities. Moreover, depending on the terms of the agreement, the lessee has the right to buy this property at the end of the leasing agreement by paying the redemption price, or return it to the lessor.

Thus, unlike a lease agreement, a leasing agreement implies the emergence of legal relations between three parties: the seller of the property, the lessor and the lessee, and also gives the lessee the right to acquire ownership of the leased asset at the end of the agreement.

The redemption price is paid either in a lump sum at the end of the leasing agreement, or in equal shares as part of the leasing payments. According to Art. 28 of the Federal Law “On Financial Lease (Leasing)” “Leasing payments mean the total amount of payments under the leasing agreement for the entire term of the leasing agreement, which includes reimbursement of the lessor’s costs associated with the acquisition and transfer of the leased asset to the lessee, reimbursement of costs associated with provision of other services provided for in the leasing agreement, as well as the income of the lessor. The total amount of the leasing agreement may include the redemption price of the leased asset if the leasing agreement provides for the transfer of ownership of the leased asset to the lessee."

In the event that, at the end of the contract, the property becomes the property of the lessee, the purchase price of the property must be indicated in the contract (or an addendum/appendix to it) (letters of the Ministry of Finance of the Russian Federation dated November 9, 2005 No. 03-03-04/1/348 and dated 09/05/2006 No. 03-03-04/1/648) and the procedure for its payment. At the same time, the presence or absence of a redemption price in the contract affects only the tax accounting of leasing transactions.

The redemption price is taken into account for tax purposes separately from the other amount of lease payments in any order of its payment (letter of the Ministry of Finance of the Russian Federation dated June 2, 2010 No. 03-03-06/1/368). No matter how the redemption price is paid: in parts during the term of the contract as part of leasing payments, or at some point in full, or in several separate payments, the lessee is an advance paid. Like any other advance paid, until the transfer of ownership, the redemption price is not an expense taken into account when calculating income tax. Thus, the lessee's expense taken into account when calculating income tax is only reimbursement of the lessor's costs associated with the acquisition and transfer of the leased asset to the lessee, reimbursement of costs associated with the provision of other services provided for in the leasing agreement, as well as the lessor's income.

At the time of transfer of ownership, the redemption price paid to the lessor forms the initial tax value of the depreciated property. Depreciation is charged by the lessee in the usual manner, as when purchasing used property.

Accounting for transactions related to a leasing agreement is regulated by the Instructions for reflecting transactions under a leasing agreement in accounting records, approved. by order of the Ministry of Finance of Russia dated February 17, 1997 No. 15.

During the period of validity of the leasing agreement, depending on its terms, the property may be on the balance sheet of the lessor or on the balance sheet of the lessee. The most difficult case from the point of view of accounting and tax accounting of leasing operations is the case when the property is on the balance sheet of the lessee (accounting from the position of the lessee). Let us consider, using a specific example, the sequence of accounting operations in the program “1C: Accounting 8”, edition 3.0 (hereinafter referred to as the “program”) for the lessee in the specified case, taking into account the options when the property is purchased at the end of the leasing agreement, or returned to the lessor.

Example

Yantar LLC (lessee) entered into leasing agreement No. 001 dated January 1, 2013 with Euroleasing LLC (lessor) for a period of 6 months. The subject of leasing is a FIAT car, which was accepted onto the balance sheet of Yantar LLC on January 1, 2013. The costs of its acquisition by the lessor amount to 497,016 rubles. (including VAT 18% - RUB 75,816). Under the terms of the leasing agreement, the cost of a FIAT car, taking into account the redemption price, is 1,416,000 rubles. (including VAT 18% - RUB 216,000). At the same time, the redemption price vehicle is paid in equal monthly installments along with lease payments. The monthly amount of leasing payments is 106,200 rubles. (including VAT 18% - 16,200 rubles). The redemption price is 778,800 rubles. (including VAT 18% - 118,800 rubles) and its monthly amount is 129,800 rubles. (including VAT 18% - RUB 19,800). Term beneficial use vehicle 84 months. Depreciation is charged in a linear way. At the end of the contract, the FIAT car becomes the property of Yantar LLC.

The following transactions must be generated in the program (Table 1).

Table 1 - Accounting entries under a leasing agreement

Debit | Credit |

||

| The cost of fixed assets received under a leasing agreement is reflected | 76. 05 |

||

| VAT allocated in accordance with primary documents | 76. 05 |

||

| The fixed asset received under a leasing agreement is accepted for accounting | |||

| The current payment under the leasing agreement has been accrued | 76. 05 | 76. 09 |

|

| Payment under the leasing agreement has been transferred | 76. 09 | ||

| Depreciation was calculated on fixed assets received under lease | |||

| The portion of VAT corresponding to the payment made is subject to deduction. | |||

| Upon fulfillment of the terms of the leasing agreement by the parties, ownership rights transferred to the lessee. Lease payments have been paid in full | For accounting and tax accounting, appropriate entries are made in analytical registers |

||

As a result of posting the “Receipt of goods and services” document, the following transactions will be generated (Fig. 2).

Rice. 2 - Postings of the document “Receipt of goods and services”

As mentioned above, until the transfer of ownership of the property to the lessee, the redemption price is not taken into account when calculating income tax. Therefore, we will resort to manual adjustment of document movements and in the columns “Amount NU Dt”, “Amount NU Kt” we will enter the amount of the lessor’s expenses for the acquisition of property (excluding VAT) - 421,200 rubles. Redemption price 778,800 rubles. We will reflect the difference as a constant, putting it in the appropriate columns (Fig. 3).

Rice. 3 - Manual adjustment of entries in the “Receipt of goods and services” document

3. To perform the operation of accepting a fixed asset for accounting, you must create a document “Acceptance for accounting of fixed assets” (Fig. 4). This document registers the fact of completion of the formation of the initial cost of the fixed asset object and (or) its commissioning. When creating a fixed asset, it is advisable to create a special folder in the “Fixed Assets” directory for fixed assets received on lease.

The initial cost of the object, which is planned to be taken into account as fixed assets, is formed on account 08 “Investments in non-current assets”.

Rice. 4 - Acceptance of fixed assets for accounting

We will also fill in the “Accounting” and “Tax Accounting” tabs of the document “Acceptance for accounting of fixed assets”, as shown in Fig. 5 and 6.

Rice. 5 - Filling out the “Accounting” tab

Rice. 6 - Filling out the “Tax Accounting” tab

As a result of the document “Acceptance for accounting of fixed assets”, the following transactions will be generated (Fig. 7).

Rice. 7 - Postings of the document “Acceptance for accounting of fixed assets”

4. At the end of the first month of the leasing agreement, the next leasing payment is accrued. To reflect this operation, you can enter the operation manually or use the “Debt Adjustment” document (the “Purchases and Sales” tab, the “Settlements with Counterparties” section) with the “Debt Transfer” operation type (Fig. 8).

Rice. 8 - Filling out the “Debt Adjustment” document

In the “Amount” field, we will manually enter the amount of the next lease payment of 236,000 rubles. = 1,416,000 rub. / 6 months (duration of the contract).

In the “New accounting account” field, indicate account 76.09 “Other settlements with various debtors and creditors.” It is he who will appear as a loan account as a result of posting the document (Fig. 9).

Rice. 9 - Posting the accrual of the lease payment

All other monthly lease payments can be calculated in the same way.

5. We will transfer the next lease payment to the lessor. To do this, first create a document “ Payment order"(Fig. 10), and then, based on this document, we will enter the document “Write-off from the current account” (Fig. 11).

Rice. 10 - Payment order for transfer of lease payment

Rice. 11 - Debiting the lease payment from the current account

After receiving a bank statement in which the write-off is recorded cash from the current account, you must confirm the previously created document “Write-off from the current account” to generate transactions” (checkbox “Confirmed by bank statement” in the lower left corner of the form in Fig. 11).

When posting the document, posting Dt 76.09 - Kt 51 is generated (Fig. 12), because according to the conditions of our example, the fact of receipt is first recorded material assets(fixed asset), then the fact of payment, i.e. at the time of payment there was an account payable to the supplier. As a result of business transactions, accounts payable were repaid.

Rice. 12 - Result of posting the document “Write-off from the current account”

6. The initial cost of the leased object is included in expenses through depreciation charges. Since the leased asset is on the balance sheet of the lessee, he monthly accrues depreciation charges on the leased asset in the amount of the depreciation rate calculated based on the useful life of this object.

To calculate the amount of depreciation charges, we will perform the “Month Closing” procedure in the “Accounting, Taxes, Reporting” section (this can also be done using the routine operation “Depreciation and depreciation of fixed assets” on the “Fixed Assets and Intangible Assets” tab). First, we will close January (depreciation will not be accrued in January, since fixed assets were taken into account in this month), and then February (Fig. 13). Before calculating depreciation and carrying out any other routine operations to close the month, it is necessary to monitor the sequence of documents.

Rice. 13 - Calculation of depreciation using the “Closing of the month” operation

As a result, the following wiring will be generated (Fig. 14)

As you can see, the posting reflects a constant difference of 9271.43 rubles, which arose due to the difference in the cost of fixed assets in accounting and tax accounting. This difference will be formed throughout the entire period of depreciation in tax accounting.

In addition to depreciation deductions, expenses in the form of leasing payments minus the amount of depreciation on the leased property are recognized monthly in the tax accounting of the lessee. In this regard, taxable temporary differences arise, which lead to the formation of deferred tax liabilities, reflected in the debit of account 68 “Calculations for taxes and fees” and the credit of account 77 “Deferred tax liabilities”. The adjustment amount is determined as the difference between the monthly lease payment excluding VAT and the amount of depreciation, multiplied by the income tax rate.

In the event that the monthly depreciation amount exceeds the lease payment amount, the expenses for tax accounting Only depreciation on the leased asset will be taken into account.

Obviously, in our example, the amount of monthly depreciation deductions is less than the amount of leasing payments. The difference is

200,000 - 14,285.71 = 185,714.29 rubles.

Therefore, it is necessary to reflect this difference as temporary for tax accounting purposes.

To pay off monthly deferred tax liabilities in accounting, you can use an operation entered manually (tab “Accounting, taxes, reporting”, section “Accounting”, item “Operations (accounting and accounting)”). The generated wiring is shown in Fig. 15. The amount of the entered transaction is equal to the above temporary difference multiplied by the income tax rate:

185,714.29 * 0.2 = 37,142.86 rubles.

Rice. 15 - Entering a manual transaction to settle a deferred tax liability

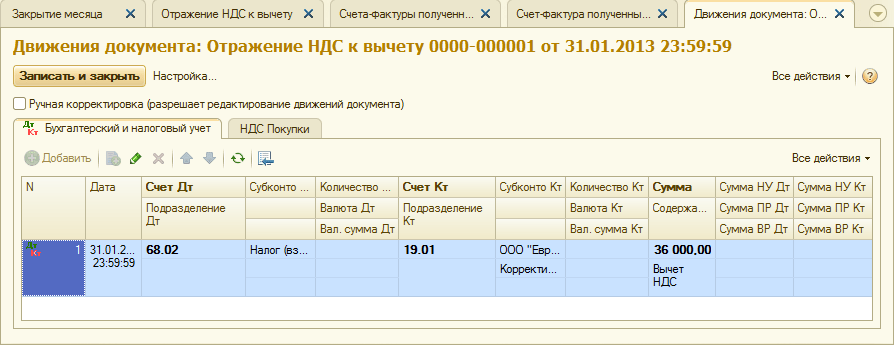

7. To reflect VAT on the lease payment accepted for deduction, we will create a document “Reflection of VAT for deduction” (tab “Accounting, taxes, reporting”, section “VAT”). Let's fill it in as shown in Fig. 16. As a settlement document, we will indicate the “Debt Adjustment” document corresponding to this lease payment.

Rice. 16 - Reflection of VAT on lease payment for deduction

It is also necessary to create an invoice received based on the created document (Fig. 17).

Rice. 17 - Form “invoice received” for lease payment

The posting generated by the document “Reflection of VAT for deduction” is shown in Fig. 18

Rice. 18 - Result of conducting the document “Reflection of VAT for deduction”

8. Upon expiration of the lease agreement and payment of the entire amount of lease payments, including the redemption price, the object is transferred to its own fixed assets.

To reflect changes in the state of the OS, the document “Changes in the state of OS” can be used (tab “Fixed assets and intangible assets”). Let's fill out its form, as shown in Fig. 19. If the “Transition of ownership of the asset upon completion of leasing” event is not in the “Asset Event” list, it must be created. When creating, specify the type of OS event as “Internal movement”.

Rice. 19 - Changing the OS state

After the transfer of ownership, depreciation parameters may change due to a change in the value of the fixed assets in tax accounting or a change in the acceleration coefficient (Fig. 20).

Rice. 20 - Changing depreciation parameters

The remaining useful life of the asset in months is indicated here (84 - 6 = 78), and the redemption price is entered in the “Depreciation (PR)” column (the difference in the initial estimate of the cost of the asset in the accounting book and NU). In the future, depreciation in NU will be calculated based on the redemption price.

In conclusion, let us consider the case when the property is returned to the lessor upon completion of the leasing agreement.

To register for the program this fact it is necessary to use a manual operation (Fig. 21).

Rice. 21 - Reflection of the return of property to the lessor

We generate transactions Dt 01.09 (“Disposal of fixed assets”) - Kt 01.01, as well as Dt 02.01 - Kt 01.09. Thus, the property was returned to the lessor with full depreciation value.

Reflection of transactions under leasing agreements in the program

"1C:Accounting 8" (edition 3.0)

The word "leasing" is borrowed from the English language. It comes from the verb “to lease”, which means “to rent, to rent”. Indeed, there are many similarities between leasing and renting. However, these concepts should not be identified.

Rent consists of the lessor transferring his property for use and temporary possession to the lessee for a fee. The object of lease can be both movable and immovable property, including land plots.

Leasing(the so-called financial lease) consists in the fact that the lessor undertakes to acquire ownership of new property specified by the lessee from a specific supplier and provide this property to the lessee for a fee for temporary possession and use (clause 4 art. 15 Federal Law dated October 29, 1998 No. 164-FZ). The subject of a leasing agreement can be any non-consumable items. As a rule, these are fixed assets, with the exception of land plots and environmental management facilities. Moreover, depending on the terms of the agreement, the lessee has the right to buy this property at the end of the leasing agreement by paying the redemption price, or return it to the lessor.

Thus, unlike a lease agreement, a leasing agreement implies the emergence of legal relations between three parties: the seller of the property, the lessor and the lessee, and also gives the lessee the right to acquire ownership of the leased asset at the end of the agreement.

The redemption price is paid either in a lump sum at the end of the leasing agreement, or in equal shares as part of the leasing payments. According to Art. 28 Federal Law “On financial lease (leasing)” “Leasing payments mean the total amount of payments under the leasing agreement for the entire term of the leasing agreement, which includes reimbursement of the lessor’s costs associated with the acquisition and transfer of the leased asset to the lessee, reimbursement of costs associated with the provision of other provided service leasing agreement, as well as the lessor’s income. The total amount of the leasing agreement may include the redemption price of the leased asset if the leasing agreement provides for the transfer of ownership of the leased asset to the lessee."

In the event that, at the end of the contract, the property becomes the property of the lessee, the contract (or an amendment/appendix to it) must indicate the redemption price of the property (letters from the Ministry of Finance of the Russian Federationdated 09.11.2005 No. 03-03-04/1/348 And dated 09/05/2006 No. 03-03-04/1/648 ) and the procedure for its payment. At the same time, the presence or absence of a redemption price in the contract affects only the tax accounting of leasing transactions.

The redemption price is taken into account for tax purposes separately from the other amount of lease payments in any order of its payment (letter from the Ministry of Finance of the Russian Federationdated 06/02/2010 No. 03-03-06/1/368 ). No matter how the redemption price is paid: in parts during the term of the contract as part of leasing payments, or at some point in full, or in several separate payments, the lessee is an advance paid. Like any other advance paid, until the transfer of ownership, the redemption price is not an expense taken into account when calculating income tax. Thus, the lessee's expense taken into account when calculating income tax is only reimbursement of the lessor's costs associated with the acquisition and transfer of the leased asset to the lessee, reimbursement of costs associated with the provision of other services provided for in the leasing agreement, as well as the lessor's income.

At the time of transfer of ownership, the redemption price paid to the lessor forms the initial tax value of the depreciated property. Depreciation is charged by the lessee in the usual manner, as when purchasing used property.

Accounting for transactions related to a leasing agreement is regulated Instructions on the reflection in accounting of operations under a leasing agreement, approved. by order of the Ministry of Finance of Russia dated February 17, 1997 No. 15.

During the period of validity of the leasing agreement, depending on its terms, the property may be on the balance sheet of the lessor or on the balance sheet of the lessee. The most difficult case from the point of view of accounting and tax accounting of leasing operations is the case when the property is on the balance sheet of the lessee (accounting from the position of the lessee). Let us consider, using a specific example, the sequence of accounting operations in the program “1C: Accounting 8”, edition 3.0 (hereinafter referred to as the “program”) for the lessee in the specified case, taking into account the options when the property is purchased at the end of the leasing agreement, or returned to the lessor.

Example

Yantar LLC (lessee) entered into leasing agreement No. 001 dated January 1, 2013 with Euroleasing LLC (lessor) for a period of 6 months. The subject of leasing is a FIAT car, which was accepted onto the balance sheet of Yantar LLC on January 1, 2013. The costs of its acquisition by the lessor amount to 497,016 rubles. (including VAT 18% - RUB 75,816). Under the terms of the leasing agreement, the cost of a FIAT car, taking into account the redemption price, is 1,416,000 rubles. (including VAT 18% - RUB 216,000). In this case, the redemption price of the vehicle is paid in equal monthly installments along with leasing payments. The monthly amount of leasing payments is 106,200 rubles. (including VAT 18% - 16,200 rubles). The redemption price is 778,800 rubles. (including VAT 18% - 118,800 rubles) and its monthly amount is 129,800 rubles. (including VAT 18% - RUB 19,800). The useful life of the vehicle is 84 months. Depreciation is calculated using the straight-line method. At the end of the contract, the FIAT car becomes the property of Yantar LLC.

The following transactions must be generated in the program (Table 1).

Table 1 - Accounting entries under the leasing agreement

|

Debit |

Credit |

||||||||

|

For accounting and tax accounting, appropriate entries are made in analytical registers |

|||||||||

As a result of posting the “Receipt of goods and services” document, the following transactions will be generated (Fig. 2).

Rice. 2 - Postings of the document “Receipt of goods and services”

As mentioned above, until the transfer of ownership of the property to the lessee, the redemption price is not taken into account when calculating income tax. Therefore, we will resort to manual adjustment of document movements and in the columns “Amount NU Dt”, “Amount NU Kt” we will enter the amount of the lessor’s expenses for the acquisition of property (excluding VAT) - 421,200 rubles. Redemption price 778,800 rubles. We will reflect the difference as a constant, putting it in the appropriate columns (Fig. 3).

Rice. 3 - Manual adjustment of entries in the “Receipt of goods and services” document

3. To perform the operation of accepting a fixed asset for accounting, you must create a document “Acceptance for accounting of fixed assets” (Fig. 4). This document registers the fact of completion of the formation of the initial cost of a fixed asset item and (or) its commissioning. When creating a fixed asset, it is advisable to create a special folder in the “Fixed Assets” directory for fixed assets received on lease.

The initial cost of the object, which is planned to be taken into account as fixed assets, is formed on account 08 “Investments in non-current assets”.

Rice. 4 - Acceptance of fixed assets for accounting

We will also fill in the “Accounting” and “Tax Accounting” tabs of the document “Acceptance for accounting of fixed assets”, as shown in Fig. 5 and 6.

Rice. 5 - Filling out the “Accounting” tab

Rice. 6 - Filling out the “Tax Accounting” tab

As a result of the document “Acceptance for accounting of fixed assets”, the following transactions will be generated (Fig. 7).

Rice. 7 - Postings of the document “Acceptance for accounting of fixed assets”

4. At the end of the first month of the leasing agreement, the next leasing payment is accrued. To reflect this operation, you can enter the operation manually or use the “Debt Adjustment” document (the “Purchases and Sales” tab, the “Settlements with Counterparties” section) with the “Debt Transfer” operation type (Fig. 8).

Rice. 8 - Filling out the “Debt Adjustment” document

In the “Amount” field, we will manually enter the amount of the next lease payment of 236,000 rubles. = 1,416,000 rub. / 6 months (duration of the contract).

In the “New accounting account” field, indicate account 76.09 “Other settlements with various debtors and creditors.” It is he who will appear as a loan account as a result of posting the document (Fig. 9).

Rice. 9 - Posting the accrual of the lease payment

All other monthly lease payments can be calculated in the same way.

5. We will transfer the next lease payment to the lessor. To do this, we will first create the document “Payment order” (Fig. 10), and then, based on this document, we will enter the document “Write-off from the current account” (Fig. 11).

Rice. 10 - Payment order for transfer of lease payment

Rice. 11 - Debiting the lease payment from the current account

After receiving a bank statement, which records the debiting of funds from the current account, it is necessary to confirm the previously created document “Writing off from the current account” to generate transactions” (checkbox “Confirmed by bank statement” in the lower left corner of the form in Fig. 11).

When posting the document, posting Dt 76.09 - Kt 51 is generated (Fig. 12), because according to the conditions of our example, the fact of receipt of material assets (fixed assets) is first recorded, then the fact of payment, i.e. at the time of payment there was an account payable to the supplier. As a result of business transactions, accounts payable were repaid.

Rice. 12 - Result of posting the document “Write-off from the current account”

6. The initial cost of the leased object is included in expenses through depreciation charges. Since the leased asset is on the balance sheet of the lessee, he monthly accrues depreciation charges on the leased asset in the amount of the depreciation rate calculated based on the useful life of this object.

To calculate the amount of depreciation charges, we will perform the “Month Closing” procedure in the “Accounting, Taxes, Reporting” section (this can also be done using the routine operation “Depreciation and depreciation of fixed assets” on the “Fixed Assets and Intangible Assets” tab). First, we will close January (depreciation will not be accrued in January, since fixed assets were taken into account in this month), and then February (Fig. 13). Before calculating depreciation and carrying out any other routine operations to close the month, it is necessary to monitor the sequence of documents.

Rice. 13 - Calculation of depreciation using the “Closing of the month” operation

As a result, the following wiring will be generated (Fig. 14)

As you can see, the posting reflects a constant difference of 9271.43 rubles, which arose due to the difference in the cost of fixed assets in accounting and tax accounting. This difference will be formed throughout the entire period of depreciation in tax accounting.

In addition to depreciation deductions, expenses in the form of leasing payments minus the amount of depreciation on the leased property are recognized monthly in the tax accounting of the lessee. In this regard, taxable temporary differences arise, which lead to the formation of deferred tax liabilities, reflected in the debit of account 68 “Calculations for taxes and fees” and the credit of account 77 “Deferred tax liabilities”. The adjustment amount is determined as the difference between the monthly lease payment excluding VAT and the amount of depreciation, multiplied by the income tax rate.

If the monthly depreciation amount exceeds the lease payment amount, only depreciation on the leased object will be taken into account in tax accounting expenses.

Obviously, in our example, the amount of monthly depreciation deductions is less than the amount of leasing payments. The difference is

200,000 - 14,285.71 = 185,714.29 rubles.

Therefore, it is necessary to reflect this difference as temporary for tax accounting purposes.

To pay off monthly deferred tax liabilities in accounting, you can use the operationentered manually (tab “Accounting, taxes, reporting”, section “Accounting”, item “Operations (accounting and accounting)”). The generated wiring is shown in Fig. 15. The amount of the entered transaction is equal to the above temporary difference multiplied by the income tax rate:

185,714.29 * 0.2 = 37,142.86 rubles.

Rice. 15 - Entering a manual transaction to settle a deferred tax liability

7. To reflect VAT on the lease payment accepted for deduction, we will create a document “Reflection of VAT for deduction” (tab “Accounting, taxes, reporting”, section “VAT”). Let's fill it in as shown in Fig. 16. As a settlement document we will indicate the “Debt Adjustment” document corresponding to this lease payment.

Rice. 16 - Reflection of VAT on lease payment for deduction

It is also necessary to create an invoice received based on the created document (Fig. 17).

Rice. 17 - Form “invoice received” for lease payment

The posting generated by the document “Reflection of VAT for deduction” is shown in Fig. 18

Rice. 18 - Result of conducting the document “Reflection of VAT for deduction”

8 . Upon expiration of the lease agreement and payment of the entire amount of lease payments, including the redemption price, the object is transferred to its own fixed assets.

To reflect changes in the state of the OS, the document “Changes in the state of OS” can be used (tab “Fixed assets and intangible assets”). Let's fill out its form, as shown in Fig. 19. If the “Transition of ownership of the asset upon completion of leasing” event is not in the “Asset Event” list, it must be created. When creating, specify the type of OS event as “Internal movement”.

Rice. 19 - Changing the OS state

After the transfer of ownership, depreciation parameters may change due to a change in the value of the fixed assets in tax accounting or a change in the acceleration coefficient (Fig. 20).

Rice. 20 - Changing depreciation parameters

The remaining useful life of the asset in months is indicated here (84 - 6 = 78), and the redemption price is entered in the “Depreciation (PR)” column (the difference in the initial estimate of the cost of the asset in the accounting book and NU). In the future, depreciation in NU will be calculated based on the redemption price.

In conclusion, let us consider the case when the property is returned to the lessor upon completion of the leasing agreement.

To register this fact in the program, you must use a manual operation (Fig. 21).

Rice. 21 - Reflection of the return of property to the lessor

We generate transactions Dt 01.09 (“Disposal of fixed assets”) - Kt 01.01, as well as Dt 02.01 - Kt 01.09. Thus, the property was returned to the lessor with full depreciation value.

About the company Foreign language courses at Moscow State University

About the company Foreign language courses at Moscow State University Which city and why became the main one in Ancient Mesopotamia?

Which city and why became the main one in Ancient Mesopotamia? Why Bukhsoft Online is better than a regular accounting program!

Why Bukhsoft Online is better than a regular accounting program! Which year is a leap year and how to calculate it

Which year is a leap year and how to calculate it